Background

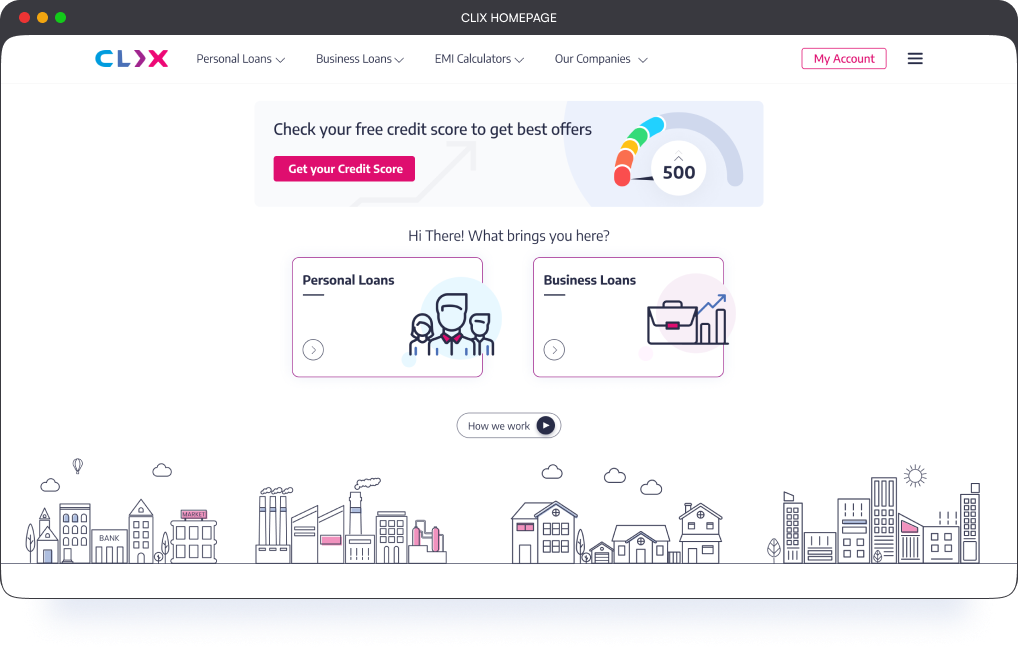

CLIX Capital, a leading Non-Banking Financial Company (NBFC), is embarking on a groundbreaking journey to digitalise the loan application processes for both personal and business loans. This initiative aims to enhance user experience, streamline processes, and improve accessibility for a broader range of applicants.

Objective

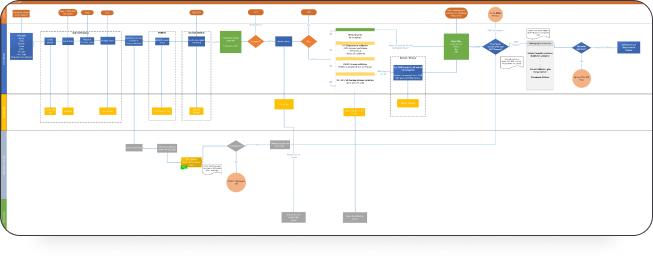

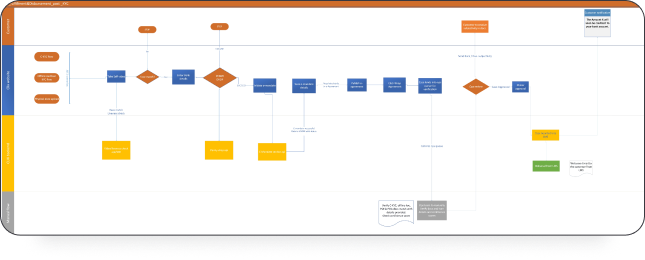

Optimise digital journeys, focusing on Quick Data Entry, income verification, KYC processes, and seamless loan disbursement.

Quick Data Entry Form Optimization

Income Verification and KYC Process

Loan Disbursement Process

my role

timeline

tools

Adobe XD

Illustrator

Sketch

Whimsical

Jira

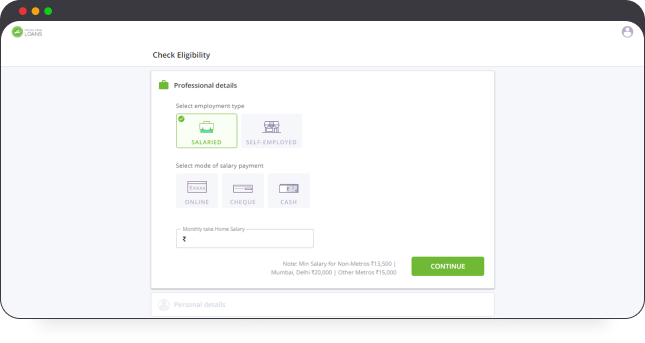

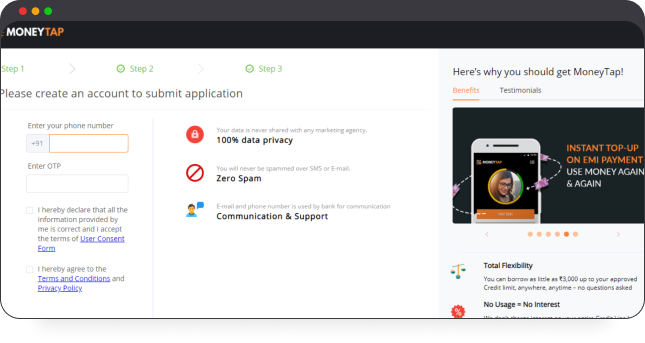

Conducted a comprehensive competitive analysis on emerging loan providers, including MoneyView, MoneyTap, and PaySense. The goal was to understand their user journeys, make comparisons, and identify pain points and opportunities. This analysis will inform the enhancement of our own loan disbursement journey.

The D2C (Direct-to-Consumer) and loan disbursement journey underwent development in collaboration with product and engineering teams. Consideration of backend and legal dependencies preceded the design phase to ensure a comprehensive and compliant approach.

CHALLENGE

SOLUTIONS

RESULTS

Seamless New Feature Integration

Added check credit score CTA, providing a valuable service without overshadowing primary loan offerings.

Decreased Drop-offs

Notable reduction in drop-off rates, enhancing user engagement.

Clear Prioritization

Guided users towards critical actions, aligning with business goals.

CHALLENGE

SOLUTIONS

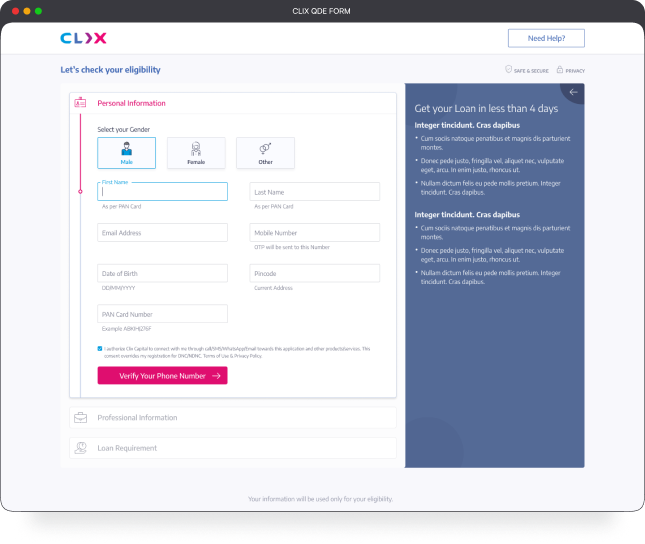

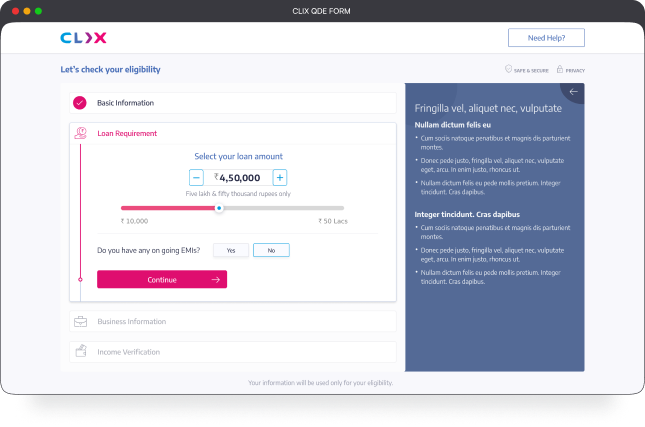

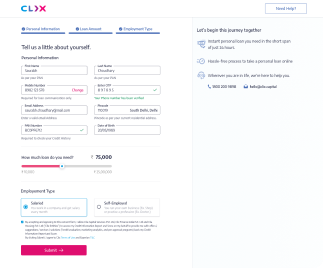

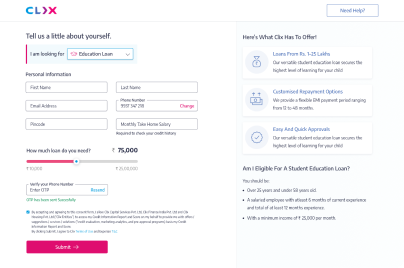

Progressive Disclosure in QDE Form

In benchmarking various products, we identified key elements for optimal user experience. The wireframes prioritize each section based on importance, adhering to Hick’s law to reduce visual clutter. The concept centers on enhancing user focus by presenting only actionable sections, streamlining the overall design for efficiency and clarity.

RESULTS

Reduced Lead Conversion Time

Notable reduction in drop-off rates from 40% to 10%, enhancing user engagement.

Minimized Cognitive Load

Streamlined QDE form eased cognitive load, enhancing user-friendliness.

Efficient Data Collection

Auto-fetching data expedited form-filling and ensured accurate information.

Improved User Guidance

Dynamic panel reduced confusion, enhancing the overall user experience.

CHALLENGE

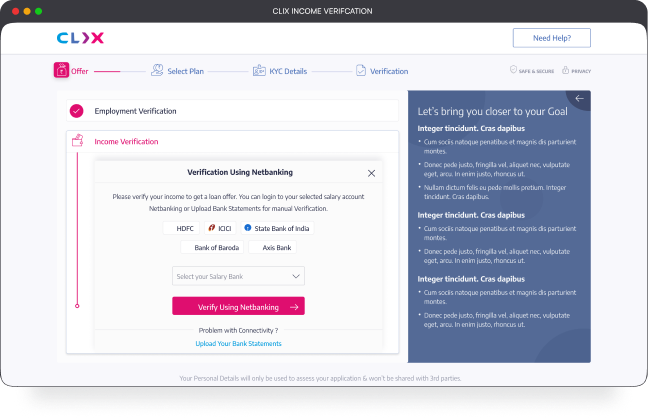

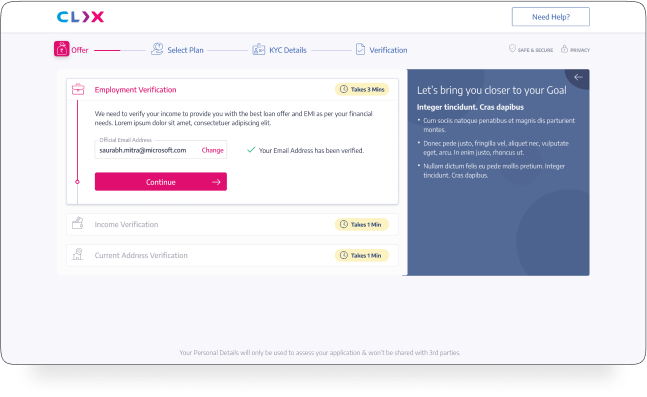

SOLUTIONS

RESULTS

Efficient Data Collection

Categorized approach facilitated targeted and efficient data collection for risk assessment.

User-Friendly Information Submission

A2 category users benefited from flexible submission methods, enhancing user-friendliness.

Reduced User Anxiety

Time estimate section reduced user anxiety by providing clear information on submission duration.

Streamlined Risk Assessment

Refined process ensured streamlined risk assessment for A2 users without unnecessary complications.

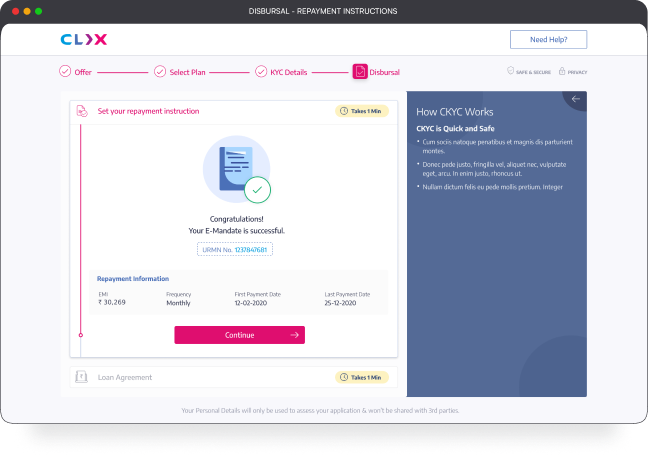

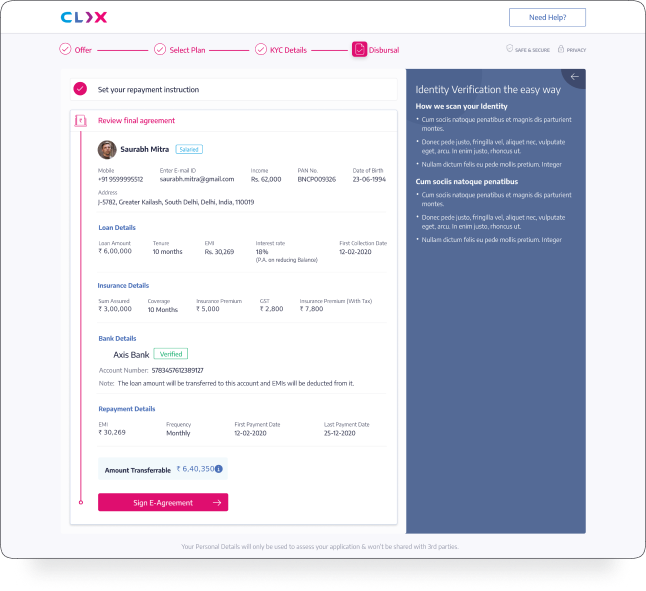

CHALLENGE

SOLUTIONS

RESULTS

Enhanced User Engagement

Intentional friction ensured active user participation in the verification process for accuracy.

Secure Bank Account Verification

Penny drop method added security, boosting user confidence in the process.

Efficient Digital Signing

Digital signing simplified paperwork, enhancing efficiency and user-friendliness.

Quick Payment Mandate Setup

Swift and mandatory setup ensured seamless establishment of the repayment process.

Time-Efficient Process

Optimized process duration of less than 8 minutes contributed to a positive user experience.